NEWSFEED HIGHLIGHTS

• Adj EPS: $0.44 (est $0.42)

• Net Sales: $1.19B (est $1.18B)

• Sees Q4 Net Sales: $1.24B–$1.28B (est $1.23B)

• Qtr Div/Sh: $0.455 (unchanged vs prior regular cash div)

• Net Sales: $213.39B (est $211.49B)

• Operating Income: $24.98B (est $24.82B)

• Operating Margin: 11.7% (est 11.7%)

• EPS: $1.95 (est $1.96)

• AWS Net Sales: $35.58B (est $34.88B)

• AWS Net Sales Ex-FX: +24% (est +21%)

• North America Net Sales: $127.08B (est $127.21B)

• Physical Stores Net Sales: $5.86B (est $5.88B)

• Oper Income Includes $610M In Asset Impairments

• Oper Income Includes Charges Of $1.1B

• Sees Q1 26 Operating Income: $16.5B–$21.5B (est $22.24B)

• Sees Q1 26 Net Sales: $173.5B–$178.5B (est $175.54B)

• Sees 2026 Capex About $200B (est $146.11B)

• Says Demand Strong For Existing Offerings

• Says Demand Strong For AI, Chips, And Robotics

• FY2025 BTC Yield: 22.8%

• Bitcoin Holdings: 713,502 BTC

• USD Cash Reserves: $2.25B As Of Feb 1

• Q4 Revenue: $123.0M (est $123.2M)

- Khorramshahr 4 Has A Range Of 2,000Km, Capable Of Carrying 1,500Kg Warhead

FEATURED STORIES

Despite leaving borrowing costs unchanged, the prospect of cheaper mortgage rates for homeowners edged closer following Thursday’s Bank of England policy decision.

As widely expected, the Monetary Policy Committee (MPC) voted to hold the Bank Rate at 3.75%. However, the decision proved far more finely balanced than markets had anticipated. Policymakers voted 5–4 in favour of no change, compared with the 7–2 or...

Central bankers once again held key interest rates in the Eurozone at levels set in June, with the monetary policy for the single currency said to still be in a good place.

On Thursday, the European Central Bank decided to stay the course for a fifth straight meeting, as predicted by economists. Officials left their benchmark discount rate at 2%, which has been hovering at that level for more than six...

LONDON – With little likelihood of a policy move from the Bank of England this week, investor attention will centre to the accompanying statement and updated economic forecasts.

The latest economist poll expects the Monetary Policy Committee to vote to keep the Base Rate unchanged at 3.75%, with the decision due at midday on Thursday.

How policymakers communicate their future intentions will be closely...

FRANKFURT – Euro area central bankers are widely expected to hold interest rates at current levels Thursday as officials continue to feel at home in the public lender’s “good place”.

Analysts said the European Central Bank looks unlikely to make any moves anytime soon, or this year for that matter, with the wide majority of economists suggesting the first shift in interest rates will come in...

Headline consumer price growth in the euro area last month extended its push beneath the target of the European Central Bank, which is expected to hold its interest rates at current levels Thursday and beyond.

In a preliminary report, the EU statistics office Eurostat said annual Eurozone inflation last month dropped to 1.7% – the market estimate – from December’s 1.9%. This pushed the measure well below the...

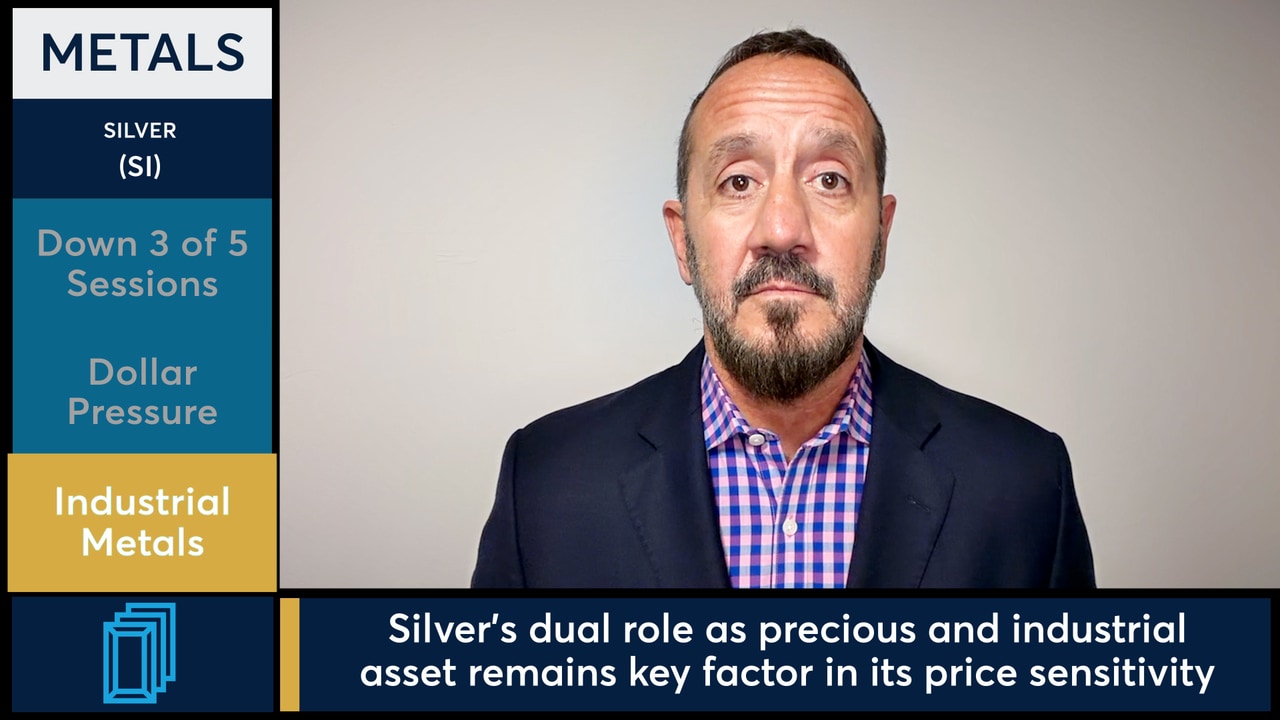

Introducing LiveSquawk Market Talk Podcast

Join market veterans for deep-dive analysis ahead of major financial events that move markets.

From Non-Farm Payrolls to central bank decisions, our expert guests break down market positioning, potential trading opportunities, and global implications.

Get the critical insights you need to stay ahead of market-moving news. Brought to you by LiveSquawk, the trusted source for real-time financial news covering 120+ countries and all major asset classes.